‘Ireland needs clear pathway to offshore wind targets to compete globally for investment’

Category

Leadership

Date

29 June 2023

Location

Ireland

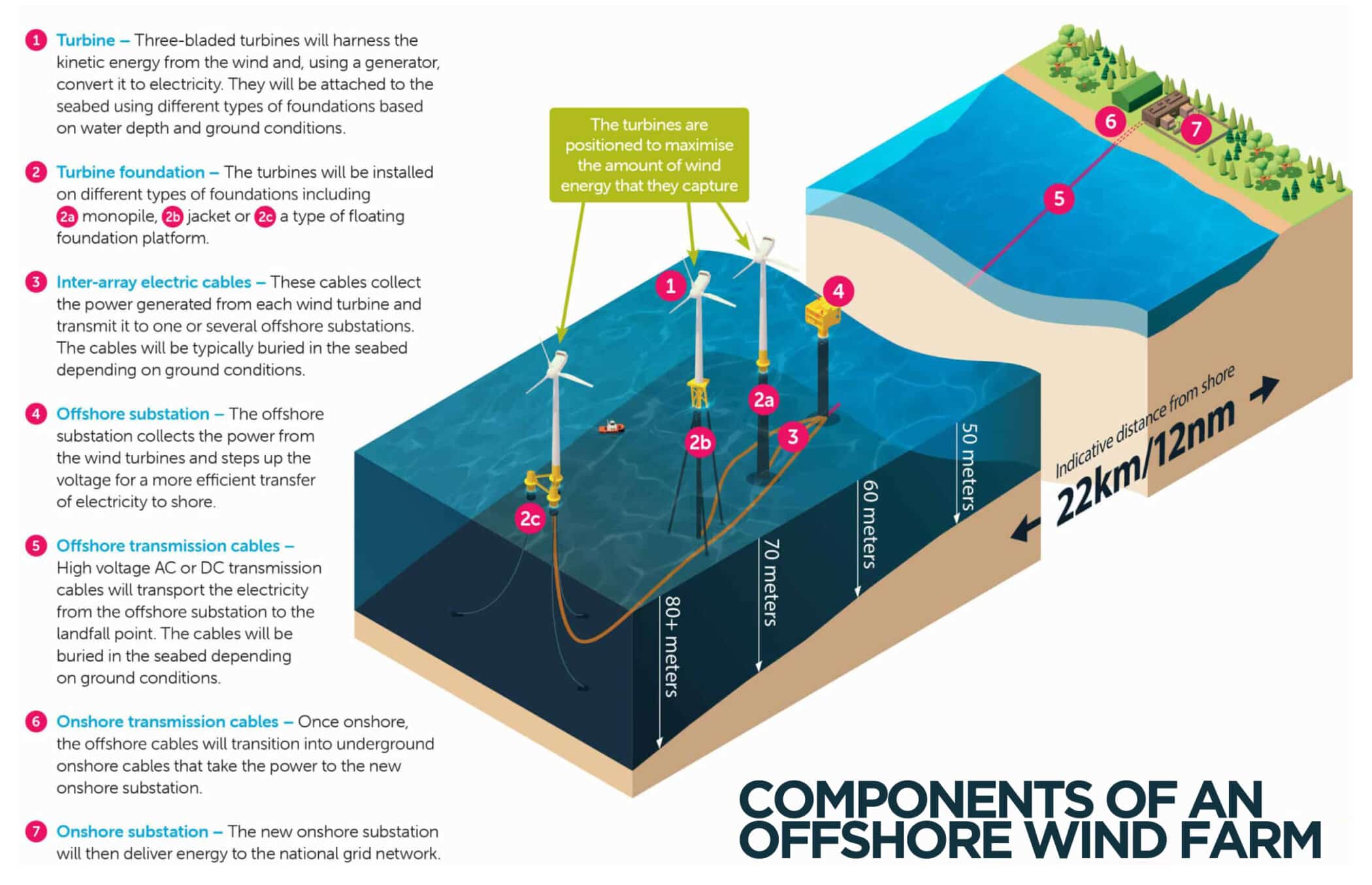

According to estimates, Ireland has more than 50 GW of offshore wind energy potential. That’s enough energy to power 37.5 million homes, and is the carbon equivalent of removing 10 million cars from the road. But is it as simple as building a big offshore wind farm, and plugging it into the grid, or private wire to an intensive electricity user like a data centre, and counting the benefits?

To find out, Craig McKechnie, host of the Echelon Power & Responsibility podcast, talked to Mainstream’s Úna Brosnan, Head of Offshore for Ireland, and Senior Offshore Development Manager Leo Quinn. Listen to the full discussion, or read the abridged interview below.

Craig McKechnie: So looking at Mainstream, you’ve got global pipeline of 21.7 gigawatts of renewable energy across four continents What projects are you working on in Ireland?

Leo Quinn: So the offshore industry in Ireland is at an early stage . The Phase One projects were these historic plans for offshore wind farms – Arklow Phase Two being a perfect example – that are going to be essentially the first offshore wind projects to be built.

Ireland’s going towards a 5 GW target by 2030, but those Phase One projects will contribute about maybe 3 GW, so there is a gap, and that’s what the Phase Two process was aimed to make up. So developers started entering the market, and that’s where we sit. We’ve identified three projects areas: off the east coast, north of Dublin; south coast off Wexford; and we’ve also identified an area on the west coast just of Shannon-Foynes.

We’ve been doing a lot of preparatory work in order to get those areas ready to enter the planning system, in the event that we were successful and were awarded a site, so that we get to hit the ground running.

Craig: And so once the Phase Two stuff happens, what kind of timeframe are we looking at and what sort of power are we looking at?

Leo: That’s a good question. We’re looking at an ever-increasingly tight timeframe for 2030 because this Phase Two process has slipped. We were expecting it to be run this year, but it looks like it’s going to push out to most likely next year, or maybe even further.

But there has been a recent reprioritisation of policy on the Phase Two side. The Government have now essentially moved from a developer-led approach to a plan-led approach. This policy was released in March and, under it, the Government are going to be running a process for between 800 and 900 MW off the south coast as the first stage of Phase Two.

Úna Brosnan: This particular shift wasn’t seen coming by industry, so there was a lot of unrest, and still is. We’re working through that with the [Government] Departments and figuring out how best we can try to minimise the slip here… making sure that the process itself needs some work and looking at how we de-risk that process.

It’s quite unusual, actually, what is proposed in the system for Phase Two. They’re looking at running the ORESS [Offshore Wind Renewable Electricity Support Scheme] auctions, which is actually what they’re running for Phase One at the minute, in advance of awarding seabed rights, which is very unusual. So that’s something we’re navigating.

And because of the change to a plan-led approach, we need to do something called DMAPs [Designated Maritime Area Plans], and that takes some considerable time. These will be some of the first DMAPs in Ireland, so obviously that comes with challenges and risk. It’s something we need to work very closely with the Government to make sure that we can streamline this as best as possible.

No doubt there will be pressure on achieving 2030 timelines here, but we need to have a collaborative approach and work with not only developers and government and various key stakeholders to make sure that we can we can minimise the risk in delivery.

Craig: The target for 2030 is 5 GW of offshore wind, and by 2050 it’s 37 GW. Currently just 25 MW is generated offshore each year, so what chance do you think we have meeting those targets?

Úna: The near-term 2030 target, with that shift in policy, is going to be quite a challenge. We’ll probably assess this heavily off the back of what is awarded in the upcoming ORESS auction and then we will be in a better position to understand what the gap is.

For 2040 and 2050 targets we’ve got a little bit more time, but by no means should we sit back and relax on this one. We’ve got some huge challenges ahead. [In particular] making sure Ireland is at the forefront of decarbonising, because is really at the crux of how we attract investment into Ireland.

Some of the big multinationals looking at renewable energy availability and access to that power in various regions around the country, then making sure that they’ve got visibility of that pipeline of secure power at the right price all the way out for the next decade.

So it is a big challenge, but equally there’s a lot on the renewable industry’s shoulders here to make sure that we are doing everything in our power to support these targets as well and realising them.

Export [of offshore wind energy] requires interconnectors, which is obviously a complete no brainer, but these things take time and currently we have minimal plans and minimal policy to support the development of interconnectors, to embrace those export ambitions.

Leo Quinn

Senior Offshore Development Manager

Craig: What would the industry like to see happen to make things easier? And I’m thinking in terms of technical and logistical challenges, and in terms of planning policy and regulation.

Úna: What developers generally call for is clear, robust policies and processes to develop projects. Investors want visibility of the pipeline and commitment from governments and minimise any changes in the regime, so they can have confidence if they’re investing in a project, but also that they can invest in supply chain and port infrastructure, or the wider infrastructure that supports that.

You know, it’s not just the development of the projects that we need to be mindful of, it’s the wider infrastructure and the impact on supply chain. I don’t think we should be shy of talking about it: a number of supply chain players have had to go elsewhere off the back of the U-turn in the policy here. That is purely off the back of some projects having to pause some development activities, and they need to move to other jurisdictions just while there’s clarification coming on some of the policy.

So it does have big impacts on industry. It really is important that we’ve got clear visible pathways to realising these projects, and making sure that we keep confidence of our investors, because we’re competing at a global level now. We’re working in a very limited supply chain at the minute.

Craig: If Ireland doesn’t push ahead with this stuff, it’s going to find itself at the back of the queue.

Úna: And this is something not only that we’re shouting about in Ireland, but it’s even in the UK, which is at the forefront of offshore wind. You’re seeing an acceleration globally off the back of the cost reduction in offshore wind. However, with our success, we’re the victims of growth basically. So we need to make sure that Ireland is seen as a relevant player within the global market.

Some examples around the limitations in the supply chain would be heavy lift vessels, [to transport] monopiles or jacket substructures supporting the offshore turbines. They come at very large day rates, they come with challenging schedules, and they’re at the mercy of weather windows as well. So securing one of these to come into an Irish market, where we’ve got a U-turn in policy, is difficult when you’ve got projects in Europe and in the UK, and more recently in the US. They’ve brought in some really aggressive policy mechanisms and tax incentives to attract industry over to the US, so we need to be very mindful of the global market. It’s by no means a regional market. We need to be mindful of how we de-risk it for Ireland PLC.

However, looking at the Atlantic and at how we semi de-risk the industry, we’ve got a great possible opportunity in floating wind. You do a lot of the assembly port-side and you have cranes with suitable hook heights and lift capacity to lift those turbines in [to the water] quayside, and then they’re towed out, so it negates the requirement for a heavy lift vessel.

But you still have challenges on the likes of turbine suppliers, looking at various electrical kit which is in short demand, particularly as we near the end of the decade.

Craig: And presumably a lot of the engineering is being done by companies that have over the last 40-50 years have done the oil rigs in the North Sea. What kind of jobs can be created in the back of the within the Irish market? How can they get into the supply chain?

Úna: It’s amazing how many Irish individuals are working abroad in the industry, and there’s some Irish supply chain already existing in the global market. There’s a number of craneage companies and, looking at the digital side, you’ve got specialists in trade and finance. There’s a plethora of engineering supports, as well. But we need to grow this expertise to make sure that we’re getting the economic benefits.

From a jobs perspective, an easy low hanging fruit is setting up O&M [Operations and Maintenance] ports maybe down the east coast. And looking at maybe wider components and logistics support, or opportunities for supply into the market, would be really, really useful.

But the key opportunity is probably digitisation and automation, and with the wealth of experience in tech, that’s something we could build on really, really quickly.

And as we move through the phases of the lifecycle of a project, we’re seeing more and more big data coming in, and we’re seeing a lot of companies supporting that. And looking at automating, there’s a company just up the east coast using remote survey technology on wind farms to do early geophysical investigations and looking at some of the wider mammal and spintech [cabling] surveys around the coast as well. So there is a great opportunity there.

Craig: Last year the government stated a preference for data centre development in locations with the potential for renewable energy generation or advanced storage. Now Echelon has signed a deal to bring ashore the 800 or so megawatts of energy that will be generated by Phase Two of the Arklow Bank Wind Farm. Is this something you expect to see more of?

Úna: Absolutely. With scarcity in the grid as well in the Irish market, I think that’s going to focus the minds to find alternative routes to market and, certainly, it makes sense that we are co-locating some of the critical infrastructure. But we need to make sure that we’re planning these right, make sure that we’re playing to our strengths on both sides of the fence, and then the commercial arrangements need to be robust to support that. But there’s so many other infrastructure requirements that need to be looked at: how we marry this with your customers; how we look at skill sets and having secure power. But the grid integrity and scarcity is one of the key factors.

Craig: EirGrid CEO Mark Foley recently said that Ireland is set for a windfall in power export, because within a couple of decades we’ll be able to produce six or seven times the electricity we need through offshore wind farms. But one of the big pinch points here is the grid, isn’t it?

Leo: Absolutely. Grid is the critical pinch point and our grid is relatively low voltage in comparison to other countries. It’s 220KV predominant transmission voltage; 400 KVs are minimal. And in the context of renewables for 2030, we’ve got the offshore, but we’ve also got plans to connect 8 GW of solar and 5 GW of onshore wind. So if you add those all into a system with a peak capacity of 6 GWs, what are we going to do with all this power? Export requires interconnectors, which is obviously a complete no brainer, but these things take time and currently we have minimal plans and minimal policy to support the development of interconnectors, to embrace those export ambitions.

Craig: So the lack of grid infrastructure might hold back the development of renewable energy for export?

Leo: Absolutely, 100%.

Craig: Is Mainstream working with the Irish grid to drive improvements? Is it going to be a case of use it or lose it, like it can be just now?

Úna: We’ve got a lot of work to do in Ireland to reinforce the grid. We don’t differ from some other countries in Europe, but there is really an urgency now to increase capacity and bolster the grid, particularly in regional areas.

There’s a lot of work going to be happening on the east coast, and you’ll probably see a lot of consent applications or planning applications come to the forefront over the next year or so. But, very much, we need to be thinking about the south and bolstering the west coast to see how we can take advantage of the opportunity there in the Atlantic. Not only just to put power in the grid, but looking at private wires into facilities, looking at decarbonisation.

Craig: You mentioned private wire. The possibility is that you have renewable energy coming directly into a substation shared with the data centre. Again, there are planning issues with that. Are there currently things that Ireland isn’t doing well enough from a regulatory point of view, are there lessons that Ireland needs to learn from abroad?

Úna: There are always going to be teething problems at the start of the new market, and Ireland hasn’t strayed too far from that either. We have seen frustrations. We need to make sure that we get the right people in supporting the Department, supporting the key stakeholders and making sure that we’ve got robust systems and processes, and the policy and regulatory framework is there and it’s streamlined, and it can take the volume that will be put at it over the next decade.

Developers have been working very closely with Government. We have been trying to bring lessons-learned and best practice into our consultations and a number of submissions have gone into Oireachtas committees, particularly around streamlining the Government’s various policies over the last three to four years. Still, we need to put shoulder to the wheel to make sure that we’ve got things like secondary legislation in place.

We can make sure that the Departments are adequately resourced. This is something that’s probably holding back Ireland; resourcing and knowledge, expertise, in some of these stakeholders and Departments. It’s something the Department and the Minister is looking at, but it’s difficult to materialise when you’ve got a very much accelerating global market at the minute.

Planning is going to be crucial in this; de-risking the environmental planning. We need to work collaboratively, not just with Government but with each other as developers as well, and then with the various NGOs, to make sure that we bring social and economic enterprise and advantages to the Irish waters.

Úna Brosnan

Head of Ireland, Offshore

Craig: The Climate Action bill commitments for 2030 include having 80% of Ireland’s electricity from renewable sources and reducing overall emissions by 51%, before becoming carbon neutral by 2050. What are the chances of hitting either of those targets?

Úna: I think the next decade is going to be pivotal. If we can get the right investment into our ports and supporting infrastructure, that would be crucial. And the attraction of Irish supply chain setting up here to support the Irish industry, and we need to look at it from a regional perspective to make sure that we don’t have a lumpy pipeline as well.

We’ve got a really good advantage in the likes of the Celtic Sea, the west coast of the UK, or even down into France. So [it’s about] making sure that we look at the long-term view; we streamline it, we look at the risks and mitigate these as best as we can. Planning is going to be crucial in this, de-risking the environmental planning. Looking at how we bring in European law swiftly and take advantage of any of the emergency legislation, particularly what’s coming in around energy security.

But we need to make sure we do this right. The last thing we want is offshore wind to pick up a reputation that we haven’t been prudent in how we assess elements, we haven’t pushed the right environmental policy. That is not what developers are at. A lot of survey work is going on. We have a lot of data. We’re trying our best to put it to best practice, but we need to work collaboratively, not just with governments but with each other as developers as well, and then with the various NGOs to make sure that we bring social and economic enterprise and advantages to the Irish waters.

Craig: Data centres use a lot of energy, and the fact that that demand can underpin the incentive to invest in renewable energy, isn’t private wire an ideal solution? Particularly given that Ireland and the grid may not be able to handle the power that is being generated.

Úna: It’s certainly going to be at the forefront of discussion over the next five years, on how we bring a number of these wind farms to fruition. Phase Two is coming next, but with Phase Three, which is going to be geared around floating wind, there will be challenges in scarcity around grid, so it will take a strong view on how you can bring power to private wire, or looking at green hydrogen or ammonia. So you will see that starting to materialise in the next two to three years.

Craig: It’s about that mix then. When it comes to carbon neutrality and meeting growing energy requirements, it becomes about offshore wind, solar, onshore wind, green hydrogen, battery storage, data centres. Is that what we’re looking at going forward?

Leo: It is. I’ll just emphasise interconnection there, something that often gets forgotten. We have interconnectors, what we call end-to-end interconnectors, just cables running from Ireland to the UK. The next step is multi-purpose interconnectors, where you’ve got offshore wind farms connecting into that cable and, therefore, you get to bypass the congestion onshore, and this really is the future.

[Mainstream founder] Eddie O’Connor’s been talking about the European super grid for as long as I can remember. His current company, Supernode, is now making advances on superconductor materials. But this is something Ireland can’t afford to lag behind on because other jurisdictions are already making moves to establish policy for these multi-purpose interconnectors. So we’re awaiting the results of a very important Irish interconnector policy consultation, because it really does unlock the opportunity for significant scale.

Craig: Leo, Úna. Thanks very much for joining us. It’s been a fascinating insight into the real challenges in terms of logistics and manufacturing, but also the paperwork, that actually gets a project up and running.

Power & Responsibility is produced by 4TC on behalf of Echelon Data Centres.